Financial & Investment News

Keep up to date with financial news and information

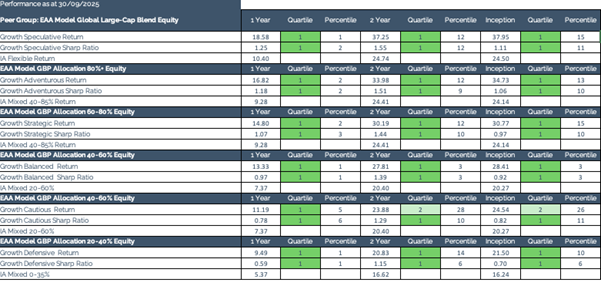

Take a look at Crossing Point’s leading performances

- Friday, November 28, 2025

Over the past year, The Crossing Point Growth Portfolios have delivered some of the strongest results in the entire UK MPS market. According to Morningstar (30/09/25), every one of the Growth Portfolios sits comfortably on page one of their respective categories – many in the top 5–10% of performers, competing against hundreds of competitors.

Consistent outperformance across every Growth mandate

Across the Crossing Point Growth range – Defensive, Cautious, Balanced, Strategic, Adventurous and Speculative – the pattern is consistent:

- Top quartile on both return and Sharpe Ratio

- Strong across 1 year, year-to-date, and six-month periods

- Top 5–10% of Morningstar peer groups

- Outperforming many of the biggest names in the MPS space

In Growth Adventurous, Strategic and Speculative especially, we are competing – and winning – against category universes of 200–400 portfolios. In Balanced and Cautious too, we’re sitting in the top handful of performers among several hundred peers.

Put simply: Crossing Point Growth Portfolios are among the strongest performers in the UK.

And it’s not just about raw returns. Our Sharpe Ratios – which measure risk-adjusted returns – also rank in the top quartiles and percentiles. This means we’re delivering strong performance without taking excessive risk. That matters, especially for clients in drawdown.

The performance is driven by process. It’s down to how we’re structured, how we select funds, and how we respond to market signals in real time.

- Strategic asset allocation built from evidence, not opinion

- Rigorous fund selection with a strict framework

- Consumer Duty indicators ensuring suitability, robustness and value for money

- Daily monitoring of all portfolios

- Trend analysis that guides when we add or trim risk

We are particularly pleased to see the portfolios performing well not just over 1 year, but across 2-year and since-inception periods as well. It suggests our processes are working across different market conditions, not just in one specific environment.

And while we’re obviously pleased with current performance, we’re not complacent. Markets change. Conditions shift. What worked brilliantly in one period may need adjustment in the next.

That’s precisely why we focus on process over outcomes. Strong performance should be a result of disciplined investing – not a goal pursued at the expense of risk management.

Because when the next market shock arrives – and it will – you’ll want to know your investment solution isn’t just riding favourable conditions, but is built to navigate whatever comes next.