This is the most ambitious spending plan in decades.

- Thursday, April 8, 2021

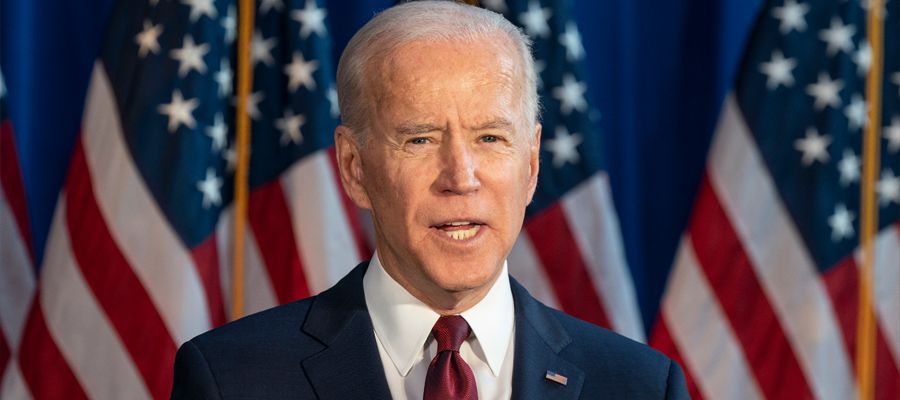

You may have noticed a recent return to form for stock markets after the correction we suffered in March after US 10-year treasury yields hit 1.7% over the expectation of higher future inflation in the USA. These recent equity market improvements have come on the back of good vaccination roll outs, some stability in US treasury yields as worries over inflation have eased, improving US employment rates and Joe Biden’s big spending plans.

You may have noticed a recent return to form for stock markets after the correction we suffered in March after US 10-year treasury yields hit 1.7% over the expectation of higher future inflation in the USA. These recent equity market improvements have come on the back of good vaccination roll outs, some stability in US treasury yields as worries over inflation have eased, improving US employment rates and Joe Biden’s big spending plans.

The S&P 500 was up 6.6% over the past month while the FTSE 100 was up 2.4%, the Euro Stoxx 50 up 5.1% and the Nikkei 225 up 3.4%.

Some key economic indicators are business confidence and employment rates. The US ISM business activity survey recently showed a record high and the US Bureau of Labor Statistics posted an increase in March employment of 916,000 new jobs. This is a big increase from the 156,000 new jobs in February. On the back of this positive news the Dow Jones hit a high of 33461 and for the first time the S&P 500 crossed the 4000 mark to hit 4077.

This surge in US job numbers comes on the back of an impressive vaccine roll out with all US adults expected to be offered a first jab by April 19th. The US has vaccinated 32% with first jabs as compared to 47% in the UK, but the pace of the vaccine roll out is likely to catch up with that of the UK. This level of vaccination along with the easing of restrictions and the re-opening of restaurants, bars, construction sites and schools are all driving up new job vacancies. March saw the highest single month increase in employment since last August with US unemployment now falling to 6%. Treasury Secretary Janet Yellen hopes that the US will be back to pre-pandemic employment rates in 2022.

During last year’s lockdown, the US lost 20 million jobs. So far it has re-gained over half but is still 8.6 million down on last year. To support the unemployed, part of the US$1.9tn stimulus package approved by Congress in February included a US$1,400 cheque to most American adults, extended unemployment benefits and funding for the re-opening of schools.

Analysts are expecting a strong rebound as families start spending again. The broader re-opening of the economy and a growing optimism as well as improving weather are all aiding the economy and stock markets.

On top of the US$1.9tn stimulus package, President Biden is taking to Congress his plans for a US$2.3tn spending plan for the upgrade of US infrastructure and the move from oil to electric power. The plans include US$600bn on modernising roads, replacing railways and rolling stock and repairing bridges. On top of this will be US$274bn on green energy initiatives including charging stations for electric cars. This is the most ambitious spending plan in decades and analysts argue it is needed to keep the US competitive. The plans will be funded over 8 years and paid for by raising corporation taxes from 21% to 28%.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763