COVID-19 and the reaction of markets to pandemic fears.

- Friday, February 28, 2020

Global equity markets have taken a significant hit this week, as investors started to take news of COVID-19 spreading beyond China to the rest of the world more seriously. We thought it would be a good time to consider the historical impact of previous pandemics on global investment markets, as well as assessing some of the likely outcomes we can expect this time round.

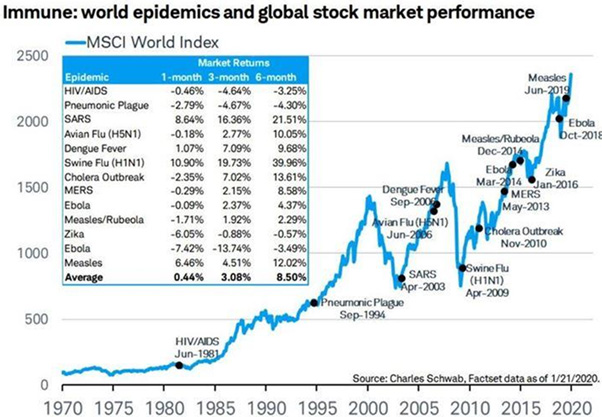

The chart below (from Alpine Macro and Charles Schwab) shows when those episodes occurred in relation to global equity market returns. The data suggests that past epidemics have not resulted in any significant or long-lasting damage to global stock prices. While certain economies and markets have been negatively impacted for short periods, most of these potential worldwide pandemic threats have proven to be just that – potential.

Make no mistake, those threats listed were severe, with some truly pandemic. According to research from the World Health Organisation (WHO), the 2009 H1N1 Mexican Swine Flu affected up to 1.4 billion people (at least one in five people worldwide were infected), and had a death rate of 0.2% and an ultimate fatality count in excess of 160,000.

In comparison to those flu-type outbreaks, the news coverage and the extent of preventative action from governments have been of a different order. Indeed, it is the preventative action that mostly affects economies and financial markets. Global manufacturing supply chains have been affected by much of China’s extended lay-off since the beginning of the year. That said, the clearest global impact of the COVID-19 outbreak so far has been on travel and events. The Six Nations Championship rugby match between Italy and Ireland (due to be played in Dublin on 7 March) is expected to be postponed, while several Serie A football matches in Italy are likely to be played behind closed doors. Conferences a month from now, especially those involving international participation, have been cancelled. There are even questions being asked as to how the Tokyo Olympics in August might be affected.

The revenues and profits of many companies will be lower in the coming months. Last week, Diageo has warned investors that revenues will be lower than expected for this fiscal year, a decrease of about 1-2%.

Some highly-leveraged companies are particularly vulnerable. The most obvious ones are in the logistics, travel and airlines industries. Energy and resource companies, which were stressed by slow global growth before the outbreak began, are facing even higher financing costs.

However, while bank share prices have fallen slightly more than the overall markets, they are not yet signalling fears of a systemic credit issue. Indeed, government bond yields have experienced a sharp fall, accompanied by a growing expectation of interest rate cuts and monetary intervention from central banks. Institutional investors now see a high likelihood that US rates will be cut by 0.25% within two months.

The probability of policy action to offset economic weakness is likely to support markets in the short-term and potentially provide fuel for a sharp bounce in future activity, most likely in the second half of 2020. That, in turn, should see company earnings expectations return to the levels that were expected a few weeks ago, and perhaps surpass them.

Yes, COVID-19 is worryingly contagious. However, most flu-type viruses are seasonal, dissipating through spring in the northern hemisphere. Despite the widening of the infected area in recent weeks, the rate of infection has slowed overall and the WHO has not changed its view that COVID-19 will follow this path, even if it may yet be classed as a pandemic. Action to prevent its spread will continue, and will be a necessary burden on the global economy. Markets may be both hurt and supported by those actions.

China provides a lot of reasons for optimism, having taken those actions. Activity is rebounding across the country already, while infection rates have declined substantially. This positive news has been overwhelmed by cases from other countries, but does suggest that the impacts can and do pass if robust action is taken.

This bout of volatility will take some time to pass, and further stock market falls are certainly possible, even likely given the nature of the news flow. However, there is good medium-to-long-term potential for trying to time any risk reduction (and increase) threatens to destroy value for investors rather than protect them.

We always aim to keep abreast of current risks but recognise that long-term investment must mean not over-reacting to them. Selling into a panic is never a good strategy. What is certain is that when this crisis is blown over (and we have every reason to assume it will), the world economy will be left with plenty of monetary and fiscal stimulus, and much reduced interest rates. The global economy started this year with expectations of positive growth, and we expect that this will still be the case even if it faces a delay.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763