Equity Markets enjoy healthy gains.

- Tuesday, October 20, 2020

Global stock markets have continued to record healthy gains in Q3 after a strong bounce back in Q2. This equity lift can be put down to a recovery in global activity, hopes of a Covid-19 vaccine and the on-going financial stimulus from governments and central banks.

Global stock markets have continued to record healthy gains in Q3 after a strong bounce back in Q2. This equity lift can be put down to a recovery in global activity, hopes of a Covid-19 vaccine and the on-going financial stimulus from governments and central banks.

There have been events that have increased risk levels leading to market re-adjustments, not least the fresh round of city and regional lockdowns across Europe, as well as the stimulus stalemate in the US ahead of the Presidential election early next month.

Markets seem to be willing so far to shrug off the increase in Covid-19 cases in Europe, but the series of tighter lockdowns has hit investor confidence. Reuters has reported that the NHS is in talks with relevant bodies including the Police and the Army, about the mobilisation of a mass vaccine programme as early as December. If a vaccine allows investors to focus on the easing of restrictions, they will be increasingly comfortable to look through the next three to six months of restrictions. A vaccine may increase the palatability of tougher measures now.

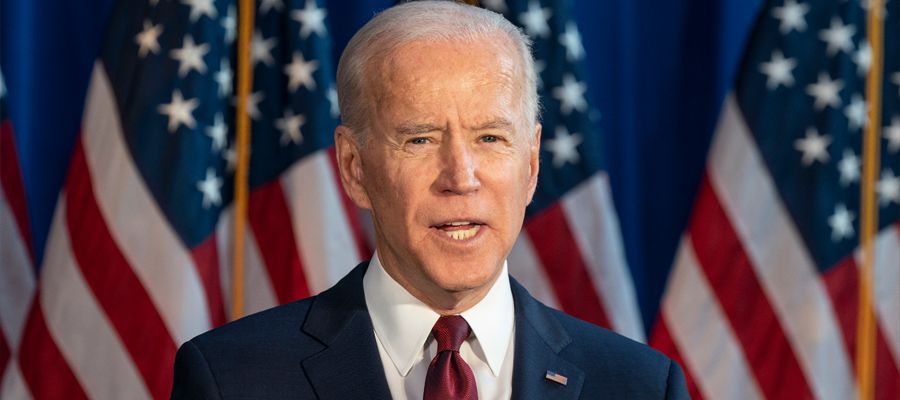

Wall St has accepted the likelihood of President Trump losing the Whitehouse to Joe Biden on 3rd November and that the Senate could also fall to the Democrats. A clear 10 point standing for Mr Biden in the polls means that the chance of an unclear and disputed result diminishes. Markets do not like uncertainty and any result that could end in months of wrangling and stalemate will harm the economy. If a result were declared invalid with Mr Trump refusing to leave the Whitehouse, this would bring the US economy to a halt with business and consumers deferring spending. Of the 14 key swing states 12 look to be going to Mr Biden.

A Biden victory and a House and Senate controlled by the Democrats will implement further fiscal stimulus at a higher rate than the Republicans were promising. The Democrat controlled House of Representatives are calling for US$2.2tn stimulus package while the Republican controlled Senate wanted to spend US$1.6tn. Mr Biden’s offer to the US people is a US$2tn investment plan focussed on infrastructure spending. The concerns that a Biden administration would reverse the corporation tax cuts of President Trump are now not such an issue for Wall St as these reforms are not expected until 2022.

The US Federal Reserves balance sheet is set to expand in value from US$7.2tn to nearly US$9tn by the end of 2021, through its programme of purchasing US$120bn bond and credit assets per month. As the US economy recovers, we would expect the levels of quantitative easing to reduce.

A further boost to global outlook has come in the form of Q3 earnings reporting. Corporate earnings have been better than analysts expected with the big US banking corporations posting some exceptional profits. First to report was Goldman Sachs who benefited from high level of trading activity through the summer, and posted a 94% increase in profits in Q3 as compared to the previous year. Goldman Sachs, JP Morgan, Blackrock and Morgan Stanley all beat analysts’ expectations and reported bumper Q3 profits despite the pandemic and economic slowdown. However, Bank of America and Wells Fargo reported falls in profits of 15% and 5% respectively, after putting aside billions to cover the cost of bad debt while being squeezed by low interest rate margins.

It has been very noticeable how different regions of the world have fared in their economic and stock market recovery since March. Key factors have been the control of the virus, as has been the case particularly in Asia, while other factors have been the exposure to certain business sectors that have prospered in lockdown, particularly tech companies, and away from energy, travel and hospitality. Equity markets to date show a clear emergence of the US, China and Japan well ahead of other markets with the UK FTSE 100 showing up particularly poorly. The figures below give the 6 months growth in index values over the 6 months to 17th October 2020.

| S&P 500 | +21.2% |

| Shanghai CSI 300 | +24.3% |

| Nikkei 225 | +21.3% |

| EuroStoxx 50 | +15.4% |

| FTSE 100 | +5.25% |

Despite on-going trade tensions between the USA and China, the equity returns from China has been one of the strongest performers this year benefiting from a weaker US$, improving economic activity, a strong tech sector and commodity price recovery.

China has now gone 6 weeks without a newly reported Covid -19 case and is starting to return to normal. Bloomberg News has reported that 425 million Chinese people went on holiday in the first week of October which is 80% of last years activity.

China has now returned to positive GDP growth for 2020 rising from -6.8% to +3.2% at the end of Q2. Industrial production has rebounded helped by a recovery in manufacturing. Chinese exports have recovered to pre-Covid levels but may in the near term be affected by second wave lockdowns around the world. The OECD expect China to end 2020 with GDP growth of +1.8% and could be back to +7% in 2021 due to an improved trading relationship with the USA from a Biden Presidency. China will be the only G20 nation to expand in 2020. The Shanghai CSI 300 index is up +12% year to date with tourism, brewing and car manufacturing stocks rallying the most as the pandemic is brought under control.

We have also witnessed a consistent run of improvements in Japanese equities. The country has done well to control the virus and economic momentum has improved. The large fiscal response from the Japanese government and very accommodating monetary policy from the Bank of Japan should continue to support the improvement in economic activity.

Our own portfolios have benefited from our asset allocation positioning. We have been for some while decisively overweight in US and Asian equity and underweight in UK and Europe. This we expect to continue in our next portfolio editions.

Asset Allocation of our Balanced Alpha Portfolio Edition 33

| Region | Portfolio | Benchmark | Difference |

|---|---|---|---|

| UK | 9% | 21% | -12% |

| US | 21% | 12% | +9% |

| Europe | 3% | 6% | -3% |

| Asia | 15% | 5% | +10% |

| Japan | 2% | 0% | +2% |

So far this year our portfolios have performed well against their respective national averages. Here are the 6 months performance results to 19th October for each of our portfolios against the relevant IA Mixed Sector averages.

| Portfolio | Benchmark | Difference | |

|---|---|---|---|

| Cautious | 8.16% | 6.82% | +1.34% |

| Conservative Alpha | 10.82% | 9.62% | +1.2% |

| Balanced Beta | 10.56% | 9.62% | +0.94% |

| Balanced Alpha | 15.35% | 13.99% | +2.3% |

| Speculative Beta | 13.30% | 13.99% | -0.69% |

| Speculative Alpha | 18.07% | 13.99% | +4.08% |

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763