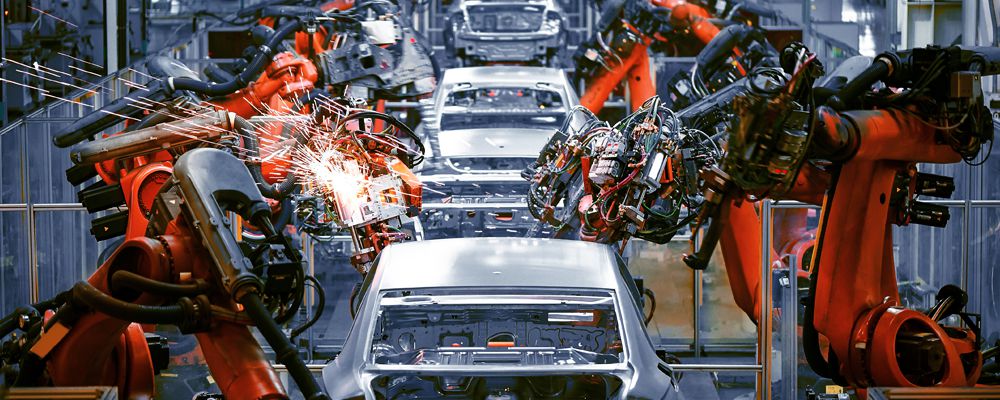

German car manufacturing has been hit by lower demand, trade disputes and Brexit unknowns

- Monday, July 8, 2019

There are concerns about the growth prospect for the Eurozone as the region delivered a disappointing performance in 2018. The Eurozone ended the year with a GDP growth rate of 1.8% the lowest for 4 years. This was driven by a decline in German car production, emissions testing, US tariffs on steel and aluminium, weaker demand from China, uncertainty over the impact of Brexit and Italy falling into recession. Only Spain demonstrated robust growth. Despite the low growth rates, employment levels grew, so that across the continent unemployment stands at a 10-year low of 7.6%. The forecasts for 2019 are 1.2% for both growth and inflation.

There are concerns about the growth prospect for the Eurozone as the region delivered a disappointing performance in 2018. The Eurozone ended the year with a GDP growth rate of 1.8% the lowest for 4 years. This was driven by a decline in German car production, emissions testing, US tariffs on steel and aluminium, weaker demand from China, uncertainty over the impact of Brexit and Italy falling into recession. Only Spain demonstrated robust growth. Despite the low growth rates, employment levels grew, so that across the continent unemployment stands at a 10-year low of 7.6%. The forecasts for 2019 are 1.2% for both growth and inflation.

Factories in Germany, France and Italy are suffering as manufacturing output shrunk. Falling global demand is now leaving factories with stockpiles of unsold goods which could lead to cut backs in production and redundancies. The May IHS Markit Manufacturing PMI confidence index for Germany fell to 44.3, France to 50.6 and Italy 49.7, the lowest ratings for 6 years.

A sense of weakening economic confidence hit German factory output in Q1 with a 1.8% decline in trade volumes, the first decline in over 9 years. The less export dependent businesses appear to have fared better, especially the professional services sector and construction. While manufacturing may be having a hard time, the rest of the German economy seems to have stabilised. The German jobs market is in good health with only 3.2% unemployed, one of the lowest in the world.

Goldman Sachs has suggested that concerns over Germany’s economy are overblown. However, the German Institute for Economic Research has downgraded forecasts for 2019’s GDP from 1.9% to 0.8%. These downgrades were due to deteriorations in the global economy. German car manufacturing has been hit by lower demand, tariff increases, trade disputes and Brexit unknowns. However, this could improve in the near term with the impact of China’s stimulus, a resolution to trade tensions and if a no deal Brexit avoided. In the medium-term, the figures could be hit by a new round of US tariffs.

Italy averted a recession in the first three months of 2019 with an expansion of GDP of 0.1%. The new coalition government admits that growth this year will likely be 0.2%. Relationships between Rome and Brussels were tested last October when the M5S Liga coalition government sought to pass a budget outside EU rules. The standoff was resolves when Rome agreed a 2% not 2.4% deficit. However, there is now an expectation that Italy will over shoot its budget and be back to test the EU resolve this coming October if not before. Analysts at Swiss Banking Group UBS are cautious about investing in Italian assets due to rising debt and little growth, but much the same can be said for France.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763