The global political will seems to be there.

- Thursday, March 26, 2020

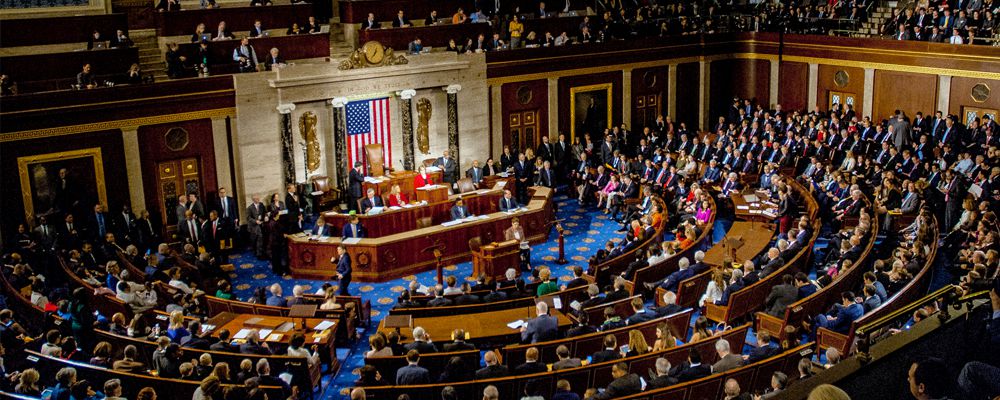

Despite some concerns at the end of the day as the US Senate wrangled over the details of the $2trn US fiscal stimulus, US markets closed in positive territory for the second consecutive day. This may not sound remarkable but it’s actually the first time this has happened in over a month, a testament to the volatility we’ve seen since the coronavirus outbreak begun. The aforementioned package passed through the Senate earlier this morning and is now set to proceed to the House of Representatives with a vote scheduled for Friday. Bar any procedural delays or indeed difficulties passing the bill, this may be signed into law as soon as this weekend putting a line under a long-awaited piece of stimulus. Meanwhile in Germany the Bundestag voted in favour of a €750bn package and therefore suspending the balanced budget that lawmakers had stuck to despite the poor economic data in 2019. The incremental passage of the US package and the passing of the German equivalent is undoubtedly buoying sentiment.

Despite some concerns at the end of the day as the US Senate wrangled over the details of the $2trn US fiscal stimulus, US markets closed in positive territory for the second consecutive day. This may not sound remarkable but it’s actually the first time this has happened in over a month, a testament to the volatility we’ve seen since the coronavirus outbreak begun. The aforementioned package passed through the Senate earlier this morning and is now set to proceed to the House of Representatives with a vote scheduled for Friday. Bar any procedural delays or indeed difficulties passing the bill, this may be signed into law as soon as this weekend putting a line under a long-awaited piece of stimulus. Meanwhile in Germany the Bundestag voted in favour of a €750bn package and therefore suspending the balanced budget that lawmakers had stuck to despite the poor economic data in 2019. The incremental passage of the US package and the passing of the German equivalent is undoubtedly buoying sentiment.

Yesterday saw the third consecutive day of single digit new case growth in Italy as well as slowing figures in the UK. Clearly day to day numbers will be volatile but the recent data suggests that lockdowns in Europe are starting to slow transmission. As part of the government daily briefing Boris Johnson confirmed that the UK had acquired 3.5 million antibody tests which could be used to see if you either have had coronavirus or are immune. The government was at pains to stress that more research would be required to know how accurate the result of the test is however it does raise the idea that global lockdowns could begin to be rolled back as those with the antibodies return to work. One of the fears that markets had was that all cases would need to be eradicated before lockdowns ended which would clearly entail a far longer timeline for economic disruption.

UK and European equities have opened down today but this is likely a profit taking from the last 48 hours of gains rather than a downward change in sentiment. Markets want to see fiscal stimulus and marginal improvement in the coronavirus news flow – this is being delivered so should support markets going forward. There are still some concerns about how quickly the announced fiscal stimulus will be rolled out into the broader economy but the global political will seems to be there which should help implementation.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763