High spending and debt funded expansion has its consequences.

- Wednesday, May 18, 2022

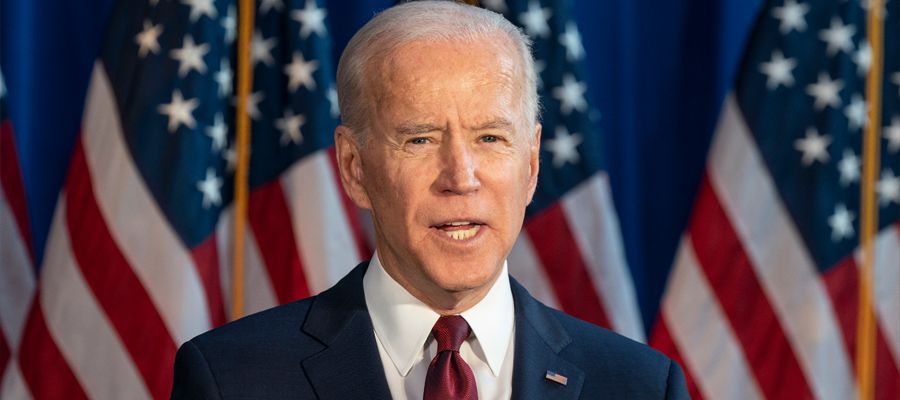

The election of Joe Biden in November 2020 was expected to become the start of a massive re-investment in America programme that paved the way for the decarbonisation of the USA and the upgrading of the country’s faltering infrastructure. The programmes were aimed at growing jobs and tackling climate change. Productivity was expected to improve as the US reversed decades of under investment in roads, bridges, railways as well as water and sewer systems. The US$1.9tn American Covid Recovery Plan was ambitious and unprecedented as was the US$2tn Green New Deal programme.

The election of Joe Biden in November 2020 was expected to become the start of a massive re-investment in America programme that paved the way for the decarbonisation of the USA and the upgrading of the country’s faltering infrastructure. The programmes were aimed at growing jobs and tackling climate change. Productivity was expected to improve as the US reversed decades of under investment in roads, bridges, railways as well as water and sewer systems. The US$1.9tn American Covid Recovery Plan was ambitious and unprecedented as was the US$2tn Green New Deal programme.

President Biden’s American Recovery and Reinvestment Act (ARRA) included spending on infrastructure and roads, child care provision, job re-training programmes, improved unemployment benefits and stimulus cheques for US$1,400 sent to every US adult citizen earning less than US$75,000 even those living abroad. This was the foundations of the US economic bounce back.

It is now over a year since the ARRA programmes were first passed into law in March 2021 as the biggest investment programme since WW2. This was followed by the Green New Deal aiming at reducing greenhouse gases and move the USA to clean forms of energy by 2030. In that year the US economy has seen GDP growth fall from 5.5% in the rolling 12-month period to Q4 2021 to 3.4% in the rolling 12-months to Q1 2022. The US economy shrunk by -1.4% in Q1. Twelve months on and this state spending has filtered through to a US cost of living crisis with inflation running at 8.5% in March. For President Biden the reality of high spending and debt funded expansion has its consequences.

The Q1 GDP figures for US growth were less than expected at -1.4% which is the first quarter of decline since the Covid pandemic in March 2020. However US imports have surged on the back of consumer demand. The US consumer remains resilient despite a cost-of-living crisis. The US consumer spending index is a key economic indicator if American continues to expand.

A second quarter of reduced growth would technically tip the US into recession which concerns for the global economy as historically when the US slows so does the rest of the world. Businesses are expecting harder times and that growth will be difficult, however analysts are expecting a stronger Q2 performance with a 3% annual GDP growth rate for 2022.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763