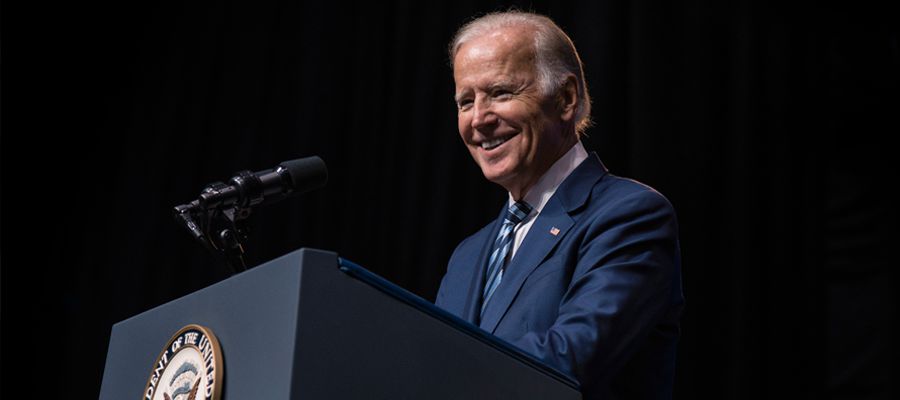

Joe Bidens economy is booming?

- Wednesday, November 29, 2023

In Q3, the US posted GDP growth figures of 4.9%. This was way above any other major developed country. This was a remarkable growth figure given the rates of inflation, interest rates and economic outlook.

In Q3, the US posted GDP growth figures of 4.9%. This was way above any other major developed country. This was a remarkable growth figure given the rates of inflation, interest rates and economic outlook.

The third quarter growth was driven by resilient consumer spending despite higher interest rates. Further study shows that much of this spending was on credit, so the pain of payment is yet to come.

In October US unemployment increased to 3.9%, which is still relatively low but up from 3.4% earlier in the year. A rise of 0.5% could be seen as a warning that the economy is slowing and that the delayed impact of interest rate rises is starting to hit the economy.

President Biden established legislation to add US$1tn to the US economy via the Inflation Reduction Act at a time when there was a huge level of monetary stimulus already pumped into the US economy. Despite Biden splashing cash and creating an economic sugar rush, Americans are not impressed with price rises and a weakened economy. For this reason, he is trailing Donald Trump in the key swing states in the lead up to next November’s US Presidential elections.

The US commercial property market is a concern. Office blocks bought when interest rates were low, now remain half empty 18 months after the end of Covid lockdowns. The return to work is not yet happening with data from entry systems showing occupancy levels are still 49% of pre pandemic levels.

If hybrid work is here to stay then business will off load leases and downsize. Commercial property is less in demand. Columbia University in New York calculated that US office space stock has lost 40% of its pre Covid value due to falling demand and falling rent revenue plus high borrowing costs. Office blocks are coming up for sale at 50% of their past value, just to get out of the mortgage.

US commercial property has US$5.5tn in borrowing against it and lenders are concerned about the refinancing of maturing loan deals. A 10-year loan in 2013 was charged at 3.5% and will now be 7.5% or more now. Lenders are being selective and if a mortgage holder cannot refinance then properties are being sold at discount values to clear the borrowing.

US regional banks are being squeezed from all sides. Interest rates for depositors have increased to stop deposit flight, their bond portfolios will be trading at a paper loss and revenue from loans is being used to fund depositors as well as loan default rates rising.

The likes of Silicon Valley Bank, First Republic Bank and Signature Bank have all failed in the past year due to the pressure of high interest rates. They are unlikely to be alone. Columbia University predict that up to 200 more US small banks will need a bail out or take over. US$2.7tn of commercial real estate debt is held by US banks with 60% held by small to medium sized regional banks. Federal Reserve officials are worried about this situation and are sending supervisory teams to those banks most exposed.

Monetary tightening hits an economy with a long lag. Only time will tell if the Fed has over tightened and compromised the small US banks and commercial property sector. News for interest rate cuts in 2024 will be welcomed by many.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763