Oil prices hit US$80pb

- Thursday, May 31, 2018

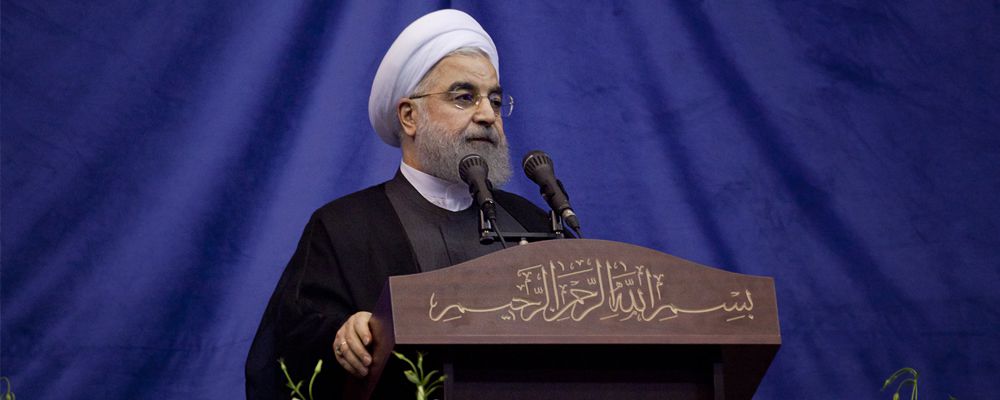

Oil prices hit US$80pb in mid-May. This is the highest price for oil in nearly four years due to the decision of the USA to impose new economic sanctions on Iran. Such a move will result in oil supplies losing their third largest producer in OPEC tightening global supply.

Oil prices hit US$80pb in mid-May. This is the highest price for oil in nearly four years due to the decision of the USA to impose new economic sanctions on Iran. Such a move will result in oil supplies losing their third largest producer in OPEC tightening global supply.

The high oil price has also been boosted by the agreement between OPEC and Russia to reduce the amount of global oil glut. The surplus in oil has now fallen from 340m barrels to 10m barrels. Strong demand due to increasing global growth has also pushed up oil prices. In Q1 it is expected that 2.5m barrels per day will be consumed. Demand for oil in Asia has hit a record high resulting in new refineries being built in China and Vietnam. China’s oil imports are the second highest ever recorded and US demand for petrol is at its highest since 2007.

If there was a further reduction in oil supply this could push prices towards US$100pb and impact upon global growth. Increasing oil prices along with wage inflation will impact price inflation and prompt faster interest rate rises than markets would want.

While strong global demand and cuts to OPEC production have pushed up the price of oil, increased shale oil production in the US should keep a lid on future price rises.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763