The outlook for US equities is positive with earnings recovery stretching into 2022.

- Thursday, April 29, 2021

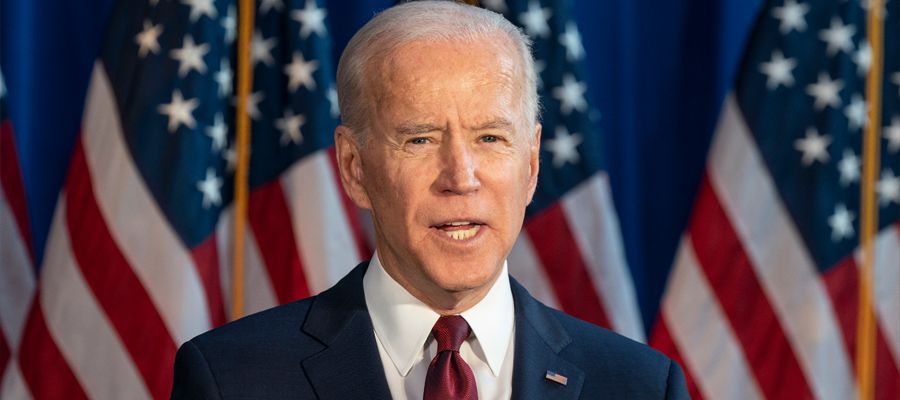

The number of new Covid cases has certainly declined in the US since the dramatic improvement in vaccination roll out rates since Joe Biden took office. The effective roll out as of mid-April, seen 64% of the US adult population receive at least one jab. The Biden administration has certainly accelerated the vaccine roll out and has set a target for 90% of all US adults to be offered a first jab by the start of May. This dramatic change in vaccination fortunes and the near 13% of GDP in fiscal stimulus agreed by Congress looks set to deliver a faster recovery in activity than expected at the beginning of 2021. Analysts are now forecasting a 6.5% growth in US GDP in 2021 and 4.5% for 2022.This is in line with the IMF projections.

The number of new Covid cases has certainly declined in the US since the dramatic improvement in vaccination roll out rates since Joe Biden took office. The effective roll out as of mid-April, seen 64% of the US adult population receive at least one jab. The Biden administration has certainly accelerated the vaccine roll out and has set a target for 90% of all US adults to be offered a first jab by the start of May. This dramatic change in vaccination fortunes and the near 13% of GDP in fiscal stimulus agreed by Congress looks set to deliver a faster recovery in activity than expected at the beginning of 2021. Analysts are now forecasting a 6.5% growth in US GDP in 2021 and 4.5% for 2022.This is in line with the IMF projections.

The overall outlook for US equities remains positive with economist forecasting a corporate earnings recovery stretching into 2022. The recent rise in US treasury yields has provoked a rotation in markets with capital leaving high price growth stocks and indebted tech stocks and moved to traditional value stock. This is one reason for the S&P 500 outperforming the Nasdaq by 11.8% to 8.5% since the start of 2021. These moves hurt our portfolios more than the national averages as we have held an overweight in US growth stock and tech stock and an underweight in value stock indexes like the UK and Europe. We think the biggest moves on US yields this year are likely to be behind us and there is an opportunity for growth stock to recover some ground.

The big tech and high PE growth stock are still seen as expensive even after the late February and early March corrections. The vaccination roll out is seeing the sectors that were originally worst hit by lockdowns now coming back and enjoying recovering earnings. We expect the high level of cash savings plus the fiscal stimulus cheques sent to every adult to push up equity valuations. The forthcoming US$2.3tn infrastructure and renewable energy plan will support industrials. Therefore, we are going to direct some of our US holdings into traditional value stock to pick up on this trend.

The US earnings season was notable for the number of companies whose first quarter earnings were above expectations. This was particularly true of the leading American banks that posted excellent profits.

The health of the US consumer is a clear and reliable measure of economic wellbeing. US spending is a key driver of the global economy. US household debt is at its lowest level for 11 years. This factor along with available credit facilities, high household savings and pent-up spending will bring about a surge in consumer demand.

The Democrat sweep of the White House and Congress in November 2020 has resulted in a massive fiscal stimulus package being passed into law. This will generate US growth and by extension global growth for the remainder of 2021 and well into 2022. The packages comprise of unprecedented flood of government relief payments amounting to US$5.6tn or 26% of annual GDP. US$3tn is to be spent on infrastructure, green investment and social spending. The total fiscal spending in the US over a seven-year period could amount to a staggering US$8.6tn or 40% of US GDP when including the quantitative easing programmes.

The immediate benefits will be felt in the households and businesses of America but the long-lasting impact will be the massive new additional public debt levels issued to fund this spending. This level of debt has not been seen since WW2 and will require the major central banks to retain ultra-low or negative interest rates for the foreseeable future. The great challenge to all central banks, starting with the Fed, is how to confront the growth in the economy and the expected inflation with the pressure to keep rates low.

Given this conflict, the credibility of the Fed will be tested by markets. This was first seen in February with bond yield rises. Despite the Feds commitment to keep rates low, we do expect to see markets test the Feds resolve as the economy re-opens. The massive fiscal stimulus is likely to fuel a very strong economic rebound. Some analysts are suggesting the IMF forecast for US GDP growth for this year of 6.5% is modest.

America has witnessed spikes in inflation in the past. A good example is the late 1960 when government overspending pushed inflation to 6% and resulted in monetary policy being excessively tightened. Over the ensuing twenty years both equity and bond markets suffered the consequences and only commodities and property gained.

The spending levels of the Lyndon Johnson era is dwarfed by that of Joe Biden. The current stimulus packages will start to support the poorer in US society who most need the help, then moves onto US infrastructure that badly needs upgrading and then onto clean energy which has to be the future. This spending spree is occurring while interest rates are 0.25% and the Feds QE programme buys up US$120bn per month of bond assets.

The Fed is forecasting that US inflation will average 2.4% this year before falling back to 2% in 2022. The Fed expects globalisation and technology advancements to hold down prices. Observers and analysts are torn between expecting excessive inflation forcing the Fed and other central banks to tighten rates and lose credibility with a resulting market fall or be able to manage their way through this with the tapering of QE in 2022 and a rate rise in 2023 when the economy is more able to absorb them. For our part we are taking some inflationary protection measures into the new portfolios.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763