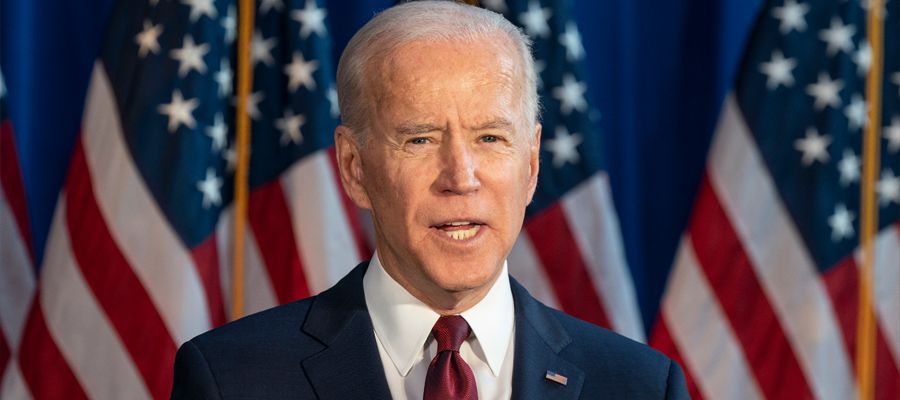

President Joe takes immediate action against common foes and converging crises.

- Saturday, January 23, 2021

Last Wednesday, the world watched on as Joe Biden’s inauguration as the USA 46th President went smoothly and without a security scare. America’s new President called for unity against the ‘common foes of hate, violence and the pandemic’ and stated that the USA is ‘facing four converging crises in Covid-19, the resulting economic crisis, climate change, and racial inequity’. Immediately on taking office Mr Biden signed 17 executive orders targeting some of his predecessor Donald Trump’s most controversial policies.

The first executive order was to make face masks compulsory across US government properties to try and combat coronavirus. Biden then signed an order which will see $1.9tn of economic help offered to those affected by Covid. The third order saw the US formally rejoin the 2015 Paris Accord aimed at combatting climate change. The new president signed further executive orders designed to give the federal government a greater role in ending the pandemic and to begin addressing Covid with a cohesive cross-agency plan. He wants to distribute 100million doses of coronavirus vaccines during his first 100 days in office, and help offer better healthcare to Americans living in poverty.

The US economy will certainly benefit from the US$1.9tn pandemic related fiscal stimulus proposed. The package includes a payment of US$1,400 directly to each American citizen, an increase in the minimum wage to US$15 per hour and support for the unemployed. This package come on top of the US$900bn stimulus package agreed in Congress before Christmas.

President Biden is also expected to launch an additional US$2tn package of climate change spending that will support the transition from oil to alternative clean energy. This climate friendly package will see massive investment in energy infrastructure, charging stations, public transport, railways and infrastructure.

With the Democrats now having a majority in the House and a casting vote in the Senate, at least until the mid-term elections, Joe Biden will have the advantage of control of Congress and not suffer the gridlock that has bedeviled many Presidents ambitions before him. He is respected and popular on Capitol Hill and well known for his cross-party negotiations, so while the Republicans may trim his budgets, he should get the main thrust of his policy through.

Former Chair of the Federal Reserve, Dr Janet Yellen is President Biden’s pick for Treasury Secretary. She is both trusted on Wall St and a veteran of the global financial crisis. She is expected to have her nomination approved and at her Senate approval hearing, she called on Congress to ‘think big and act big’. This new administration is certainly doing that.

If both of these bills are passed through Congress, then the total of US fiscal support for Covid recovery will hit US$5.2tn. This is 25% of US GDP and substantially more than provided by any other nation in the world. No one has ever seen numbers like this before.

This Biden give away is aimed at generating growth in the US economy. With this type of money to splash out, it is not surprising that the US stock market has had a remarkable recovery. The S&P 500 is up 13.1% over the past 12 months compared to Japan Nikkei 225 up 19%, the Euro Stoxx 50 index down -5% and the FTSE 100 down -12% over the same period.

The 2020 acceleration in the technology sector aided the US economy and stock market. This is a trend we do not expect to change. Current equity valuations are rich relative to historical valuations and this is particularly true in the USA where 53% of the S&P500 index companies have forward price to earnings ratios of over 20, the highest since 2006. Equity values are being supported by very depressed bond yields, which will continue while QE and stimulus packages press down on yields.

The US is likely to avoid a double dip recession and enjoy strong growth in 2021 and 2022. President Biden’s spending plans are the biggest since Franklin D Roosevelt and will look to emulate the spirit of Roosevelt’s New Deal programme of public works that helped the United States to recover from the Great Depression of the 1930s.

These stimulus packages will start to flow into people’s pockets at a time when the vaccination programme will be in full swing. These will both push up consumer activity and spending. Moody’s are expecting a 7% increase in US GDP growth in Q1 and 8% GDP growth in 2021 with unemployment falling back to 4%. Goldman Sachs predicts a 6.5% GDP growth this year while JP Morgan are forecasting a modest 5.5%.

Analysts are forecasting that overall global GDP growth will hit 5.2% for 2021, and this trend is expected to extend into 2022, as fiscal and monetary policy remains supportive.

One can argue that while the economy is in a poor shape due to Covid and lockdown, but there is momentum behind the recovery and momentum to the next age of industrial revolution in clean energy, technology and artificial intelligence.

While we can feel good about the expected recover, this level of growth is likely to result in early inflation. The Federal Reserve is hoping to keep interest rates on hold for the next 2 to 3 years as it has changed the way it measures its inflation target to an average of 2% through a cycle rather than simply hitting 2%. The Fed Vice Chair David Clarida has said that US interest rates will start to rise once US inflation tops 2% and remains there for 12 months. With US inflation at 1.4% in December, and quite capable of hitting 2% in Q2, as the US economy opens up, we could be looking at an interest rate rise in May 2022.

Inflation is likely to return with interest rates at zero, heavy government spending, pent up private spending and household deposits. Any tightening of the Federal Reserve interest rates will strengthen the US$ and increase borrowing costs across the world, which is something that no government with high national debts would want.

Economists are worried that such a massive expansion of monetary supply will almost certainly guarantee inflation as we get our lives back to normal. Inflation over 3% in the US is quite possible and higher if not controlled. This level of inflation would have an impact on asset values based upon revenue streams as inflation devalues this income. A journey from low inflation rising to significant inflation can get bumpy and stock markets could see a correction from their current optimistic values.

From a portfolio point of view it makes sense to look at inflation protection for fixed interest securities like government bonds which will be hurt by inflation, in our next portfolio review.

There is far less vigour in Europe to match the US ambitions over Covid recovery packages. The ECB have maintained their quantitative easing programme and kept interest rates on hold but there are no new plans for another fresh rescue plan for this second wave. With the first phase fiscal stimulus now coming to an end and the €1.8tn EU Recovery Fund mainly starting in the summer and spread over seven years, Europe is likely to fall behind the USA in terms of recovering from the impact of Covid. Added to the fact that the roll out of the Covid vaccine is particularly slow across Europe, then the enforced extension of a recession looks likely. For countries like Greece, Italy, Spain and Portugal this will mean further hardships. Bank of America has upgraded its USA growth forecast to +4% in Q1 2021 but downgraded Europe to -3.7%.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763