Wealth Management

Co-ordinate your investments, grow capital and increase your income.

Building Wealth

We focus our advice on creating bespoke wealth management plans that help you fulfil your financial objectives, expectations, and responsibilities. By aligning your current circumstances with your objectives, our financial advisers will work with you to create a long-term plan that also gives you the financial freedom to enjoy life to the full.

Estate Capital provide coordinated advice on deposits, investments, insurance, pensions, taxation, and estate planning, to ensure that you are getting the very best returns from all your investments.

" I’ve been a client of Estate Capital for a number of years and can honestly say they have been a pleasure to work with. Chris and his team have worked tirelessly to strive for my financial goals. With regards to my investments, ISAs, pensions, savings etc, there are dedicated members of the team that specialise in each area, and I have a periodical 6 monthly review of all my investments which falls in line with my aptitude to risk assessment. All in all, I'm very happy. "

Understanding you

We take care to understand your financial position and income requirements. Only through thorough assessment and understanding your requirements, can we construct an investment solution that is ideally suited to you. And, over time your needs and priorities will change and your financial arrangements will need to adapt accordingly.

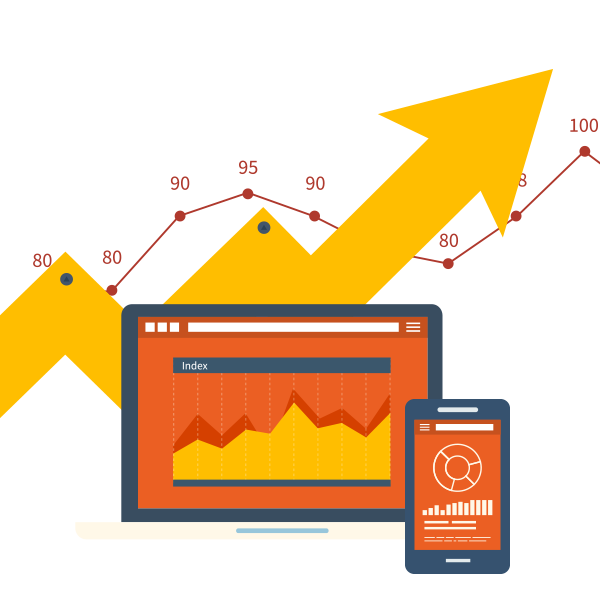

Good Returns

We want you to benefit from good investment returns as well as being comfortable with the means by which your returns are achieved. It is important that your attitude to risk and your investments are regularly reviewed to ensure that they remain aligned with your objectives.

Reviews and Rebalancing

A key part of our ongoing service to our investors is the ongoing review and reporting of portfolio performance against national average benchmarks, appropriateness of portfolio, maintaining risk boundaries, fund selections and costs and charges.

Benchmarking

All the portfolios we recommend are benchmarked against established national average performance using the Investment Association’s Mixed Investment.

Investment Solutions

We offer clients advice and access to a range of platform-based investment solutions that are designed to match the requirements of either capital accumulation, income taking decumulation, or ethical and sustainable investment. Our range of advised solutions come in the form of;

- Our Crossing Point portfolios. These portfolios are managed on a discretionary basis.

- The whole of market access to external investment company and insurance company’s products.

All our investment solutions are researched from the whole of market with each of the successful holdings meeting our due diligence and selection criteria. These criteria include performance measures, risk control, technical ratios, consistency of returns, Fund Manager ratings, management, and trading cost. We do recommend, where appropriate, internal solutions to minimise overall costs to investors.

Crossing Point Investment Portfolios

Crossing Point Investment Management Ltd is a discretionary investment management company offering a range of Model Portfolio Solutions (MPS) aimed at medium to long term investors who seek capital growth or a sustainable income from a portfolio of leading investment funds.

Crossing Point was established out of collaboration between Estate Capital Investment Management and leading financial academics from Swansea University which focussed on a form of investment management using trend-following momentum theory and market sentiment indicators. Estate Capital Investment Management Ltd supported the academic research from 2015 until 2020 which led to successful MSc and PhD submissions. The major shareholders in Crossing Point are Estate Capital Investment Management Ltd and the investment managers and academics Doctor Tomiko Evans and Professor Mike Buckle.

The six strategies are managed by Tomiko Evans, Mike Buckle, Tom Milford, Jordan Hughes and Chris Davies and offer investors unique and attractive investment portfolios. Each Crossing Point strategy is designed to deliver a specific investor outcome. Two sets of portfolios are managed using trend following and market sentiment indicators, while the other four portfolios are managed on a traditional buy, hold, and rebalance basis.

" I can highly recommend Estate Capital as a financial investment advising company. I have used Chris and team for the last 15 years and I have had nothing but positive results from their advice. They work hard to make sure your money is working hard and being placed in the right markets to ensure continuous financial growth on your investments, which is reassuring and essential during the tumultuous market we see ourselves in today! "

It’s important to remember that the value of an investment and the income received from an investment can go down as well as up. Changes in exchange rates or taxation may have an adverse effect on the price, value or income of the investments. Investment returns may be constrained by charges levied and inflation may reduce the value of investments.